Crystal Ball Gazing

With world stock markets reacting positively to increasing signs of lockdowns being eased around the world, and with events still moving very quickly, we thought it would be a good time to summarise where we seem to be and where we might be heading from a financial standpoint.

Whilst the market corrections and movements in the last few months’ are pretty normal, the global pandemic is not. In Donald Rumsfeld’s famous words, the “known knowns” are the worldwide recessions, high unemployment and the likelihood of businesses struggling to adapt to the new world. The “known unknowns” include whether we will suffer a second wave of infections, whether and when efficient vaccines can be created and distributed and exactly how politicians and central bankers will lead the way? As always, it is the “unknown unknowns” that could be the most concerning.

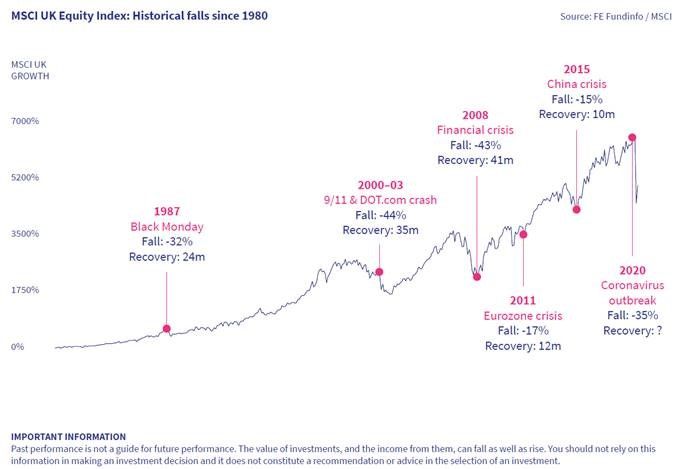

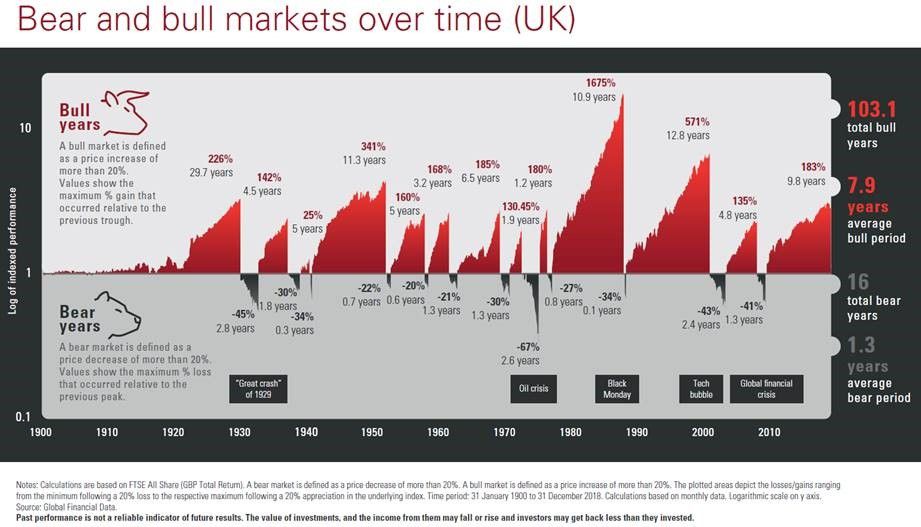

All of the ‘known’ information appears to be priced in to the markets now and, as always, the focus is very many months into the future to establish a fair value for the price of shares today. The consensus appears to be that recovery is likely and will take time; there is an increasing belief that we could be currently experiencing a ‘bear-market bounce’, so even though investment growth is likely, volatility is likely to stay for a while yet. History favours the investor and below are a couple of useful examples of what I mean by this; many investors will have experienced many of these situations previously and it is encouraging to note that over time the markets have always come out stronger than when they went in.

So for anybody looking for guidance for what to do from here, my advice is to stay invested, trust in the markets and especially to stay safe.

Recent Posts

-

22 August 2024

-

19 June 2023

-

12 April 2022

-

25 February 2022

-

17 January 2022

Archives

- August 2024

- June 2023

- April 2022

- February 2022

- January 2022

- November 2021

- September 2021

- February 2021

- August 2020

- June 2020

- January 2020

- August 2019

- July 2019

- June 2019

- November 2018

- September 2018

- July 2018

- June 2018

- April 2018

- August 2017

- May 2017

- April 2017

- February 2017

- July 2016

- June 2016

- May 2016

- March 2016

- November 2015

- September 2015

- May 2015

- January 2015

- November 2014